Secondaries: Feature or a bug in a world of less liquidity?

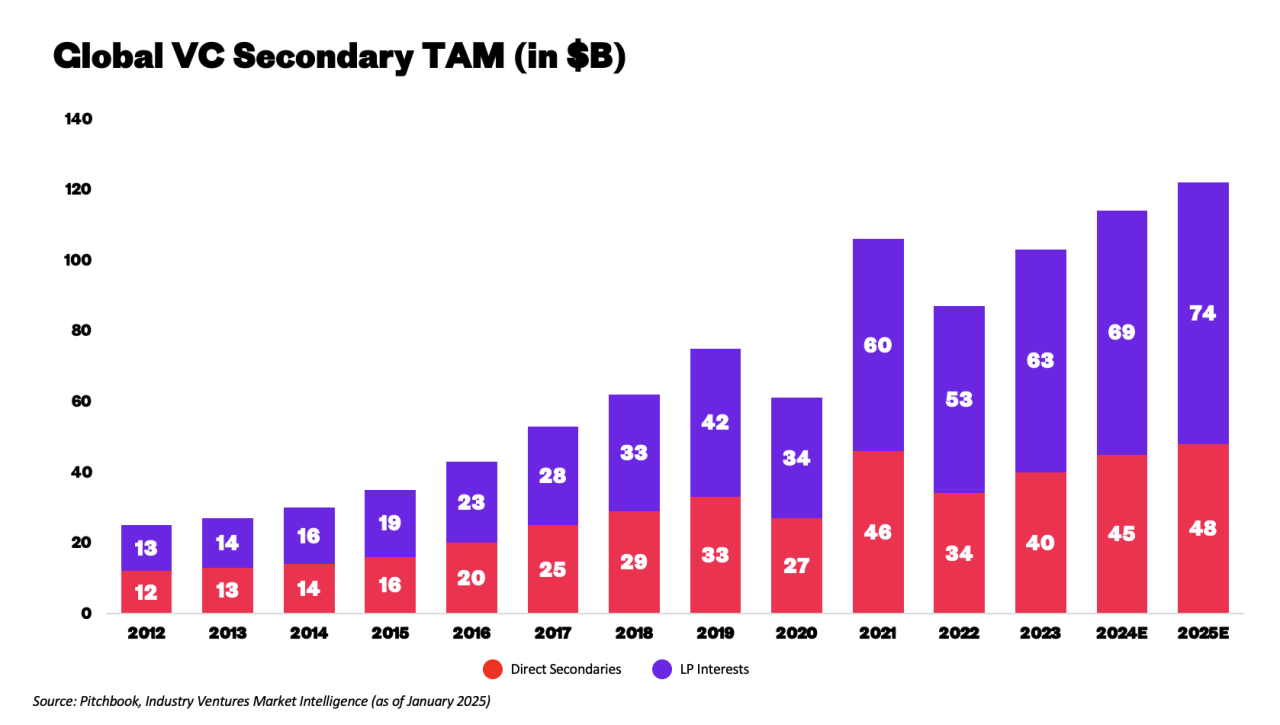

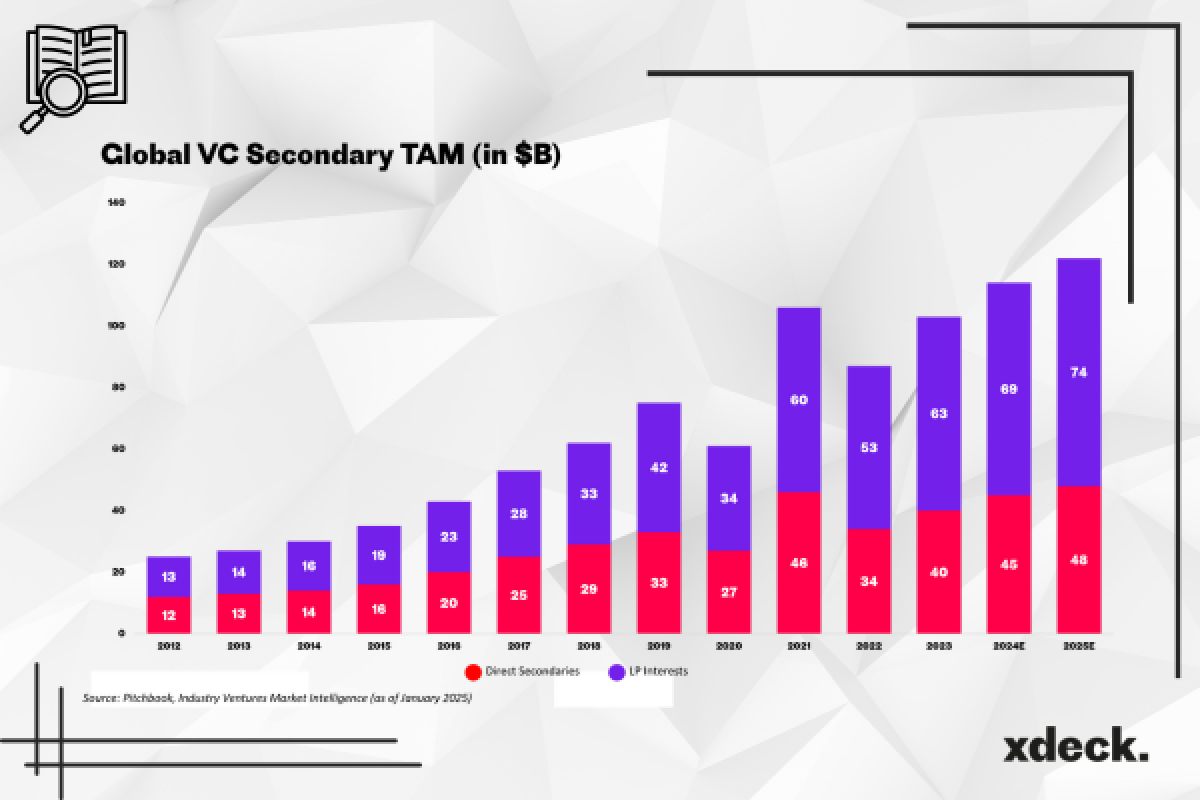

Over the past two years, secondaries have become a defining trend in venture capital. In a world where IPOs are rare and M&A sluggish, secondaries are emerging as a strategic lever - not just a liquidity workaround.

Unlike primary financings, secondaries involve existing shareholders (often founders, early investors, or employees) selling shares to new investors. This shift is changing the way startups think about ownership, alignment, and control.

After the 2021 valuation peak, markets declined in 2022–2023. With fewer exit options, investors began turning to secondary deals as a liquidity release valve (Ferstl & Tönies, 2025). Cap tables had become congested, growth-stage companies remained private longer, and stakeholders sought partial liquidity without waiting for an IPO.

Cap tables are getting smarter - and founders (and investors alike) increasingly use secondaries to clean up the shareholder base and regain control of the cap table. This matters. As cap tables grow more fragmented across rounds, misaligned investors, each potentially with their own expectations, can stall decisions. Secondaries allow early exits for some and invite newly aligned backers to the table.

Incentive systems are shifting too. With more employees and founders accessing liquidity before a final exit, VCs are rethinking equity incentive plans. There’s growing recognition that partial liquidity doesn’t kill motivation - in fact, it can help avoid burnout and align stakeholders for the long haul.

At the same time, these deals are legally and structurally complex. Especially in jurisdictions like Germany, where notarization, ROFRs, and tag-alongs complicate transactions, expert support and aligned communication with existing shareholders are essential (Ferstl & Tönies, 2025).

And this is no longer just about small ticket sizes: recent deals like Vinted (€340M), Raisin (€100M), and Back Market (€70M) show how company-led secondary programs are maturing rapidly. New investors - including family offices, pension funds, and dedicated secondary managers - are stepping in as strategic players (Goerbing, 2025).

So - is early liquidity through secondaries a curse or a feature?

When done right, it’s a feature. Founders get room to breathe without stepping away. Teams de-risk without losing focus. Cap tables stay clean, and new strategic investors can come in.

For startups with longer exit horizons, a well-structured secondary can be just what keeps things moving.

Author: Susanna Engl

Soures:

https://www.goingpublic.de/going-public/secondary-deals-erobern-den-vc-investmentmarkt/

https://www.vc-magazin.de/blog/2025/04/28/revival-in-turbulenten-zeiten/

https://www.vc-magazin.de/blog/2023/10/13/secondaries-venture-capital/